Fresh-start Reporting What Is It and What Are the Benefits and Risks

Fresh-start Reporting What Is It and What Are the Benefits and Risks

"Fresh-start Reporting" (Fresh Start) is the term applied to the rules that allow companies to present their assets, liabilities and equity as a "new entity" on the day the company emerges from chapter 11 bankruptcy protection. The topic is relevant, as several large companies have recently emerged from bankruptcy and issued financial statements adopting Fresh Start. This article examines the requirements of Fresh Start, including some of the benefits and some of the risks associated with its implementation.

American Institute of Certified Public Accountants (AICPA) Statement of Position 90-7: Financial Reporting by Entities in Reorganization under the Bankruptcy Code (SOP 90-7) is the authoritative literature that defines Fresh Start. The fresh-start provisions of SOP 90-7 may only be applied if the following two conditions are met:

- Reorganization value of the debtor is less than post-petition liabilities and allowed claims (i.e., the debtor is "balance sheet" insolvent), and

- Existing voting shares immediately before confirmation receive less than 50 percent of the voting shares of the emerging entity.

According to the statements, entities that adopt Fresh Start should apply the following principles:

- The reorganization value of the entity should be allocated to the entity's assets in conformity with the procedures specified by Financial Accounting Standards Board (FASB) Statement No. 141, Business Combinations (commonly referred to as "purchase accounting"). If any portion of the reorganization value cannot be attributed to specific tangible or identified intangible assets of the emerging entity, such amounts should be reported as goodwill in accordance with the requirements of FASB Statement No. 142, Goodwill and Other Intangible Assets.

- Each liability existing at the reorganization plan confirmation date, other than deferred taxes, should be stated at present values of amounts to be paid determined at appropriate current interest rates.

- Deferred taxes should be reported in conformity with generally accepted accounting principles (GAAP). Under current guidance, deferred taxes are not discounted, making deferred tax balances the only balances presented on a nominal dollar basis on the reorganized entity's financial statements.

- Tax benefits realized from pre-emergence net operating loss carry-forwards should first reduce goodwill until exhausted and thereafter be reported as a direct addition to paid-in capital.

- Changes in accounting principles that will be required in the financial statements of the emerging entity within the 12 months following the adoption of Fresh Start should be adopted at the time Fresh Start is adopted.

Companies that meet the conditions for Fresh Start generally include information on the effects of the accounting as an exhibit in their disclosure statement. In order to take the reader of the disclosure statement from the historical balances on the company's financial statements to the fresh-start presentation, the exhibit typically includes a "bridge" from the company's financial statements as they exist prior to emergence to the expected financial statement balances of the rehabilitated company. The bridge shows the reader impact of debt discharge, recapitalization and valuation adjustments on the balance sheet. Typically, the balance-sheet bridge is presented in a five-column format. However, the format can vary between companies, as specifics of the method of presentation are not addressed in SOP 90-7.

Like purchase accounting, the application of Fresh Start is relatively easy at the company's top consolidation level. Modifying the company's books and records to institutionalize the accounting is the more difficult task. Issues that require attention include:

- Understanding the corporate and reporting structure and whether to push down Fresh Start adjusting entries by legal entity or operating level or hold all adjustments at the parent or some other interim level;

- Understanding the tax balance sheet and how it has been affected by the debt discharge, as well as the continuing requirements to track book and tax basis; and

- Understanding the sub-ledgers and reporting systems, including those adjustments that are necessary to "clean up" liabilities.

Although the requirements and implementation steps discussed above are beneficial to most companies that adopt Fresh Start, there are also inherent risks associated with Fresh Start.

Fresh Start is analogous to "purchase accounting." However, Fresh Start differs in certain important respects. With Fresh Start, there is no one-year adjustment period in which to "true-up" estimates related to the transaction. Uncertainties that were not resolved during the chapter 11 proceedings may continue to exist after the company emerges from bankruptcy. Such uncertainties are referred to as "pre-confirmation contingencies." A pre-confirmation contingency could be a contingent asset, a contingent liability or a contingent impairment of an asset.

According to AICPA Practice Bulletin 11: Accounting for Pre-confirmation Contingencies in Fresh Start Reporting, after the adoption of Fresh Start, adjustments that result from a pre-confirmation contingency are to be included in the determination of net income from continuing operations in the period in which the adjustment is determined and separately disclosed. Such adjustments can result from resolution of a contingency or changes in estimates of amounts initially recorded at emergence from chapter 11.

Resolution of pre-confirmation contingencies could have a direct, and in some cases material, impact on the financial statements of a company after it has emerged from chapter 11. In addition, a company that adopts Fresh Start and emerges from chapter 11 with large amounts of goodwill and other intangible assets is susceptible to impairment charges should the company not meet the underlying financial projections that formed the basis for the enterprise valuation.

Two companies that recently emerged from chapter 11, US Airways Group Inc. and The Warnaco Group Inc., reported detailed Fresh Start disclosures in their annual and quarterly reporting that help to illustrate the risks associated with Fresh Start.

US Airways Group Inc.

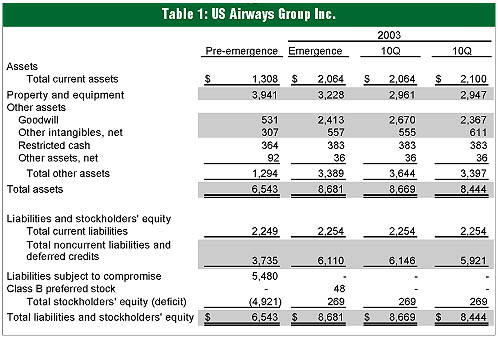

Table 1 compares the condensed balance sheet of US Airways Group Inc. pre-emergence to the condensed balance sheet as disclosed in the Fresh Start footnote to the financial statements at emergence and in the two quarters following emergence.3

Pre-emergence, US Airways reported approximately $3.9 billion of property and equipment and $500 million of goodwill. As a result of revaluing its assets and liabilities and implementing Fresh Start, upon emergence from chapter 11 US Airways reported approximately $3.2 billion of property and equipment and $2.4 billion of goodwill, as disclosed in the Fresh Start footnote to the financial statements. In the two quarters that followed, US Airways reported additional changes to its balance sheet at emergence. Based on the information contained in the public filings, US Airways re-allocated amounts assigned to goodwill and intangible assets to property and equipment and noncurrent liabilities and deferred credits at emergence. These amounts changed as a result of changes in estimates subsequent to emergence. Although US Airways did not report an income statement charge related to the change in estimates, had there been underestimates that related to other areas such as pension liabilities, post-retirement benefits and settlement of litigation (amounts that are significant), an income statement charge would have been taken subsequent to emergence.

US Airways has recently renegotiated its financing agreements due to non-compliance with debt covenants resulting from weaker-than-expected financial performance. Should US Airways fail to meet the financial projections that it submitted as part of its emergence from chapter 11, there is a risk that goodwill and other identifiable intangible assets could be impaired (meaning that the carrying value of the assets is greater than the fair value of the assets, as calculated using an appropriate methodology). Due to the state of the airline industry and US Airways's recent financial performance, the risk of an impairment charge related to the carrying value of its goodwill and intangible assets is one that US Airways continues to face.

The Warnaco Group Inc.

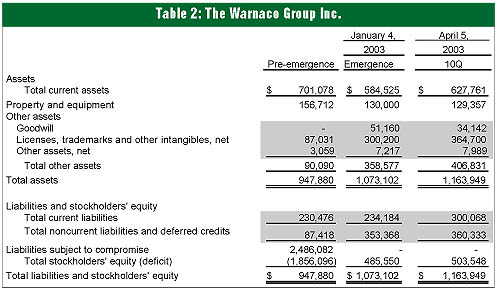

Table 2 compares the condensed balance sheet of The Warnaco Group Inc. pre-emergence to the condensed balance sheet as disclosed in the Fresh Start footnote to the financial statements at emergence and at the quarter following emergence.4

As a result of adopting Fresh Start, Warnaco reported approximately $51 million of goodwill and approximately $300 million of licenses, trademarks and other intangible assets. Prior to Warnaco's emergence, its financial statements reflected no goodwill value and approximately $87 million of licenses, trademarks and other intangible assets. Like US Airways, Warnaco also reported subsequent changes to the balance sheet at emergence, as disclosed in the Fresh Start footnote, in the quarter that followed. Warnaco re-allocated amounts to licenses, trademarks and other intangible assets as well as current assets. Warnaco did not incur any income statement charges related to the reallocation, since the changes were a reallocation of estimates among balance-sheet balances.

Both Warnaco and US Airways confirmed reorganization plans that distributed a "pot" of value to the creditors. Under such pot plans, since the total value to be distributed to creditors is fixed regardless of how big or small the pool of pre-petition claims, there is less risk that pre-confirmation contingencies related to the estimated value of pre-petition claims will result in a charge to the emerged entity's income statement. In plans where creditors are satisfied by a fixed return per claim dollar, the chances of post-emergence financial statement impact from claims estimation become increasingly greater in reverse proportion to the status of the company's claims-resolution process at the date of emergence.

Although there are significant benefits associated with adopting Fresh Start, there are also clear risks that can affect the emerged company. Understanding Fresh Start will be especially relevant to the financial community in the coming fiscal quarters as large companies such as Exide Technologies, Global Crossing, Peregrine Systems and MCI adopt Fresh Start and report their financial statements subsequent to emerging from bankruptcy.

Footnotes

1 Anthony F. Caporrino is a manager in Huron Consulting Group's Corporate Advisory Services practice. He has a wide variety of experience in the reorganization of companies and in performing accounting due diligence for financial buyers. Return to article

2 Views expressed in this article are those of the author and not necessarily those of Huron Consulting Group LLC. Return to article

3 All information was obtained from the available public SEC filings. All amounts are presented in millions of dollars. Return to article

4 All information was obtained from the available public SEC filings. All amounts are presented in thousands of dollars. Return to article