You never thought bankruptcy would give you too much. But sometimes it does.

You never thought bankruptcy would give you too much. But sometimes it does.

When you file for Chapter 7 bankruptcy, the goal is to get out of debt. The discharge does just that – it ends your personal liability for debts that are wiped out in bankruptcy.

So long as a debt is not one of those that is not discharged, your liability ends at the end of the case.

Credit Reporting Of Discharged Debts After Bankruptcy

The Federal Trade Commission, in the famous Brinckerhoff-Lovern letter of April 24, 1998, spells out exactly how a debt discharged in bankruptcy must be reported. It states as follows:

Section 607(b) of the FCRA requires credit bureaus “to follow reasonable procedures to assure maximum possible accuracy of the information concerning the individual about whom the report relates.” In our view, it is not a reasonable procedure to label an account that has been discharged in bankruptcy as “charged off as bad debt” if the account was open and not charged off when the consumer filed bankruptcy. Such a designation would be inaccurate or misleading, because it would indicate that the creditor had written off the account at the time of bankruptcy when it had not in fact done so.

What If A Discharged Debt Is Reported As Due And Outstanding?

As far as the FTC is concerned, reporting anything but the fact that the debt was discharged in bankruptcy and now has $0 due is inaccurate. Therefore, you should dispute under the Fair Credit Reporting Act to correct the error. If the error persists, there may be grounds for a lawsuit.

In a few of my cases on the subject, the U.S. Bankruptcy Court held that such an inaccuracy may also be considered a violation of the discharge injunction under the bankruptcy laws.

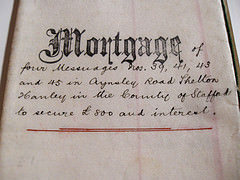

Your Mortgage Was Discharged

In most cases, your personal liability to pay your mortgage was discharged at the end of your Chapter 7 bankruptcy. That means if you fail to pay, the lender can forclose but isn’t allowed to come after you for the deficiency after the foreclosure sale.

It means you owe $0 on your mortgage. You’re paying the security interest, but there’s no personal liability.

The mortgage company isn’t allowed to report on the account – at all. No payments, no balance, no skipped payments. Nothing.

That’s good if you fall behind, but if you’re up-to-date you’re not going to “get credit” for those payments.

How To Prove Payments

Under federal law, you can ask your mortgage company for a payment history at any time. That payment history will show all payments you’ve made, as well as the amounts and dates of those payments. You can take that to a new potential lender or anyone who wants to verify that you’ve been making your mortgage payments.

Reaffirmation

You could always use the reaffirmation process in bankruptcy to avoid the problem. A reaffirmation is a promise to repay a debt in spite of your bankruptcy – in essence, to pretend as if the bankruptcy never happened as to that particular creditor.

You can reaffirm a debt while the bankruptcy case is open, but many judges won’t let you reopen a closed case for the purpose of reaffirming a debt. Talk to your lawyer to see if that’s an option for you.

But remember, reaffirmation can be dangerous. Once you reaffirm a debt, you’re on the hook in case things go badly in the future. I don’t usually recommend reaffirmation to my clients, but that’s on a case-by-case basis.

The Bargain Of Consumer Protection

You want to be protected from creditor shenanigans after bankruptcy. In exchange for that, it’s up to you to keep records of your mortgage payments after the discharge is entered. And if there’s a problem, give a call to your bankruptcy lawyer. If he or she isn’t familiar with the rules, have them give me a call to talk about it – I’m happy to share the knowledge to help you get the protection you deserve.

Image credit: Rev Dan Catt

How Your Mortgage Shows Up On Your Credit Report After Bankruptcy was originally published on Consumer Help Central. If you're seeing this message on another site, it has been stolen and is being used without permission. That's illegal, a violation of copyright, and just plain awful.

- Log in to post comments