| NEWS AND ANALYSIS |

|

Senate Republicans Fail to Advance "Skinny" Stimulus Bill as Stalemate Continues

The Senate failed today to advance a Republican coronavirus stimulus plan, the latest blow to stalled efforts to pass another package to mitigate the pandemic’s economic damage, CNBC.com reported. The measure fell short of the 60 votes needed on a procedural step to move toward passage. All Democrats present, and one Republican — Rand Paul of Kentucky — opposed it in a 52-47 vote. The nearly unanimous vote for the GOP followed weeks of disagreements within the Republican caucus about whether to pass any more aid at all. The legislation would have reinstated enhanced federal unemployment insurance at a rate of $300 per week, half of the $600 weekly payment that expired at the end of July. It also would have authorized new small business loans and put money toward schools and into Covid-19 testing, treatment and vaccines. The measure did not include a second $1,200 direct payment to individuals. It also lacked new relief for cash-strapped state and local governments or money for rental and mortgage assistance and food aid — all priorities for Democrats. “It is beyond insufficient. It is completely inadequate,” Senate Minority Leader Chuck Schumer (D-N.Y.) said of the GOP plan earlier today. Senate Majority Leader Mitch McConnell (R-Ky.) brought the measure to the Senate floor this week as efforts by the Trump administration and Democratic leaders to strike a bipartisan relief agreement remained stalled. He aimed not only to show that Republicans, and particularly vulnerable GOP senators running for reelection this year, were taking action to fight the pandemic, but also to put pressure on Democrats ahead of Election Day. Congress has failed to pass a fifth coronavirus aid package even as the outbreak infects tens of thousands of Americans per day and economic pain felt by millions of jobless people sharpens. Lifelines including the jobless benefits, a federal moratorium on evictions and the window to apply for Paycheck Protection Program small business loans have all lapsed. While President Donald Trump has taken unilateral steps to extend temporary unemployment aid to some Americans and limit evictions for a few months, only Congress can pass comprehensive relief because it controls federal spending. Doubts have grown about lawmakers’ ability to approve any more stimulus during the heated final weeks before the 2020 election. Even so, House Speaker Nancy Pelosi told reporters Thursday she is hopeful Congress can pass another bill before the Nov. 3 election.

|

|

|

|

Trump Administration’s Handling of Stalled Student Debt Relief Claims Threatens Proposed Settlement

A proposed court settlement between the Trump administration and defrauded borrowers is in jeopardy after the administration revealed its widespread denials of requests for student debt cancellation, the Washington Post reported. Ninety-four percent of the debt-relief claims the Education Department has processed since reaching the agreement in April have been rejected, the department said in a court filing last week. The federal agency issued 78,400 decisions, of which 4,400 were approved and the remainder denied. Attorneys for the borrowers in the class-action lawsuit say that the rejection letters lack detailed explanations for the denials, making it difficult for people to appeal the decisions. They say that the department’s hasty disposal of the claims without a clear cause violates the spirit of the agreement, which is still pending final approval. Under the proposed deal, the Education Department agreed to clear out nearly 170,000 unresolved claims within a year and a half. Borrowers who are still awaiting a decision after 18 months would get 30 percent of their federal loans discharged for every month that the department is late, and those who are denied reserve the right to an appeal. The agreement stems from a lawsuit brought against Education Secretary Betsy DeVos and her agency in June 2019 by a group of borrowers seeking debt relief under a federal program known as “borrower defense to repayment.” That program, which dates to 1994, provides federal loan forgiveness to students whose colleges lied to get them to enroll.

In related news, the prospects for major changes to student loan forgiveness hinge largely on the outcome of the November elections, both presidential and congressional, The Hill reported. Democratic presidential nominee Joe Biden and President Trump are offering significantly different proposals for the size and scope of canceling student debt, creating a crossroads that experts say could play a key role in how Americans approach higher education. Under Biden’s plan, individuals would pay 5 percent of their discretionary income toward their education debt, followed by forgiveness after 20 years. Individuals earning $25,000 or less per year would not owe any payments on their federal student loans, nor would they accrue interest on their loans. The plan would be coupled with lowering the cost of tuition to help reduce student loans. Public colleges and universities would be tuition-free for families with incomes below $125,000, while two years of tuition-free community college or training programs would be offered for certain students. Key elements of Trump’s student loan plan were outlined in his fiscal 2020 budget proposal. Overall, his approach would combine multiple income-driven repayment programs into one. Among the programs that would be eliminated is the Public Service Loan Forgiveness program, which cancels federal student loan debts for full-time government or nonprofit employees after a certain amount of years. Trump’s plan also calls for 12.5 percent payment of discretionary income with forgiveness after 15 years for undergraduate debt and 30 years for graduate students.

|

|

|

|

Do Jobless Benefits Deter Workers? Some Employers Say Yes. Studies Don’t.

The $600-a-week jobless benefit supplement that Congress approved in March as part of the CARES Act has been widely credited by economists with keeping the economy functioning through the coronavirus pandemic, the New York Times reported. Households used the extra cash to pay rent, buy food and cover medical, utility and credit card bills when many businesses abruptly shut, and cars lined up for miles at food banks. With the supplement, which ended in July, most unemployed workers got more than they had earned in wages; without it, they fell short of their previous income. Workers, businesses, policymakers and scholars have all had differing perspectives on whether the supplement simply provided a lifeline or discouraged people from taking jobs. The answer has consequences for tens of millions of Americans, particularly those on the lower end of the income ladder; for businesses trying to restore their operations; and for an economy that largely depends on the lifeblood of consumer spending. There has been striking agreement among conservative and liberal economists who have studied the issue that the $600 supplement has deterred few workers from accepting a job. But the relief is not only a matter of contention among business owners; it is also at the center of an acrimonious debate in Congress that has held up agreement on a new aid package. Democrats have insisted on extending the full $600 payment beyond July, while Republicans are pushing for no more than $200, arguing that the extra income is deterring people from working. President Trump decided to use federal disaster relief funds to give most jobless workers $300 a week, but officials said the funds would cover only four or five weeks of payments. The issue is likely to continue to resonate through the election campaign. For most people collecting unemployment benefits, there are simply no jobs. Roughly half of the 22 million jobs that evaporated with the coronavirus outbreak have not yet returned. Freelancers, gig workers, the self-employed and others have also seen their contracts and incomes shrink. But what about those who declined to return to a previous job, or take a new one? Turning down a job offer to stay on unemployment insurance is considered fraud and is grounds for losing all jobless benefits. But many states suspended verification checks, and with the flood of claims, keeping track of applicants’ job searching can be difficult. So can determining the reason for declining a job. A lack of child care or health concerns related to COVID-19 are generally considered acceptable excuses. Making more money on unemployment insurance is not.

|

|

Justice Department Has Charged 57 People with Trying Steal $175 Million in Coronavirus Relief Funds

The Justice Department has so far charged 57 people with trying to steal a total of $175 million in taxpayer-backed coronavirus pandemic loans, officials said today, part of a months-long effort to stamp out profiteering as the federal government continues to spend giant sums of money to stimulate the economy, the Washington Post reported. The Paycheck Protection Program, a taxpayer-subsidized loan program that is regulated by the Small Business Administration and implemented by banks and financial technology companies, has been a fraud concern from the moment it was rolled out in early April. Funds were disbursed with relatively little vetting, and businesses were allowed to self-certify their own eligibility. “The PPP program represented critical help at a critical time,” acting assistant attorney general Brian C. Rabbitt told reporters on Thursday. “Unfortunately, the crisis brings out not only those that try to help others, but those who try to take advantage of the crisis for personal gain.” Those charged include individuals who allegedly received money on behalf of fake companies; legitimate business owners accused of spending the funds on luxury items for themselves rather than on employees’ paychecks; people who allegedly knew they weren’t eligible but applied anyway; businesses that allegedly double-dipped in a program meant to provide one loan per business; doctors accused of stealing from patients; and elaborate rings of people accused of trying to steal tens of millions of dollars. The $175 million that fraudsters have attempted to steal has entailed a known loss of $80 million to the government, officials said. The Justice Department was able to recover $30 million.

|

|

|

|

U.S. Unemployment Claims Held Steady Last Week

U.S. unemployment claims held steady at 884,000 last week, the Labor Department reported Thursday, a sign the labor-market recovery is losing steam six months after the coronavirus pandemic struck the U.S., the Wall Street Journal reported. Claims have fallen from a March peak of about 7 million but remain at historically high levels — above the pre-pandemic record of 695,000. The total number of workers receiving assistance from state and federal programs also remained high in late August, as more workers turned to pandemic-related programs for assistance. The total of about 29.6 million people, which isn’t seasonally adjusted and lags two weeks behind new state claims figures, includes temporary federal pandemic-related programs for self-employed and gig workers in addition to those receiving regular state benefits. The number of workers collecting state unemployment benefits has also dropped from highs reached earlier in the pandemic but remains elevated at historically high levels. So-called continuing claims increased to about 13.4 million at the end of August. State reopenings helped boost employment this summer, and gains continued in August, but at a slower pace, Friday’s Labor Department report said. The bulk of the decline in jobless claims at the end of August reflected a change in how the Labor Department calculated seasonal adjustments, economists said. The agency’s methodology change, which will be applied to claims figures going forward, is intended to better align the adjusted figures with raw numbers distorted by the pandemic. (Subscription required.)

|

|

|

|

Commentary: A Surprisingly Durable Stock Market Recovery Faces Tougher Tests*

When the stock market began to rally back in March, it seemed oblivious to an economy sliding into its worst contraction since the Great Depression, the Wall Street Journal reported. Nearly six months later, some of that optimism has proved justified. The economy touched bottom in April, and it has clawed back ground every month since. The recovery has shown surprising resilience in the face of resurgent coronavirus infections and expiring fiscal stimulus. That’s the good news. The less-good news is that recovering the remaining ground may be tougher, which may be why the stock market has wobbled recently. Back in May, economists projected unemployment would still be 11 percent this December. Last month, it dropped to 8.4 percent. August was the fourth straight month the job market outperformed economists’ expectations. As the economy shrank at a record 31.7 percent annual rate in the second quarter, economists saw only a halting recovery. In July, IHS Markit, an economic analysis firm, projected gross domestic product would expand 17.7 percent annualized in the third quarter. But most economic indicators since have been better than projected, and IHS now sees GDP growing 29.6 percent in the third quarter, which ends Sept. 30. Goldman Sachs is even more optimistic, projecting a 42 percent gain. One reason for this comeback is unprecedented monetary and fiscal stimulus. After the Federal Reserve slashed interest rates to near zero in March and boosted purchases of government bonds, mortgage rates plunged. As a result, new home sales hit a 13-year high in July, and home construction is back to pre-pandemic levels. Congress supplied households and laid-off workers with enough added income to more than offset lost wages, bolstering retail sales. More important is that, unlike typical recessions, this one was caused by a natural disaster — the COVID-19 pandemic and related restrictions on economic activity. Typically, when a disaster fades, activity snaps back to its previous level. While the pandemic hasn’t passed, the economy did begin to reopen in May, and a new wave of infections across the South and West didn’t reverse that. “I’d have expected a resurgence in infections to produce more caution in consumers,” said Ben Herzon, an economist at IHS Markit. But “we haven’t seen it yet.” (Subscription required.)

*The views expressed in this commentary are from the author/publication cited, are meant for informative purposes only, and are not an official position of ABI.

|

|

Proposed Amendments to Bankruptcy Rules and Forms Published for Public Comment

On June 23, 2020, the Judicial Conference Committee on Rules of Practice and Procedure (Standing Committee) approved publication of proposed amendments to the following:

• Appellate Rule 25;

• Bankruptcy Restyled Rules Parts I and II; Rules 1007, 1020, 2009, 2012, 2015, 3002, 3010, 3011, 3014, 3016, 3017.1, 3017.2 (new), 3018, 3019, 5005, 7004, and 8023; and Official Forms 101, 122B, 201, 309E-1, 309E-2, 309F-1, 309F-2, 314, 315, and 425A;

• Civil Rule 12 and Supplemental Rules for Social Security Review Actions Under 42 U.S.C. § 405(g); and

• Criminal Rule 16.

The comment period is open from Aug. 14, 2020, to Feb. 16, 2021. For information on the proposed amendments and instructions on how to submit comments, please click here.

|

|

|

|

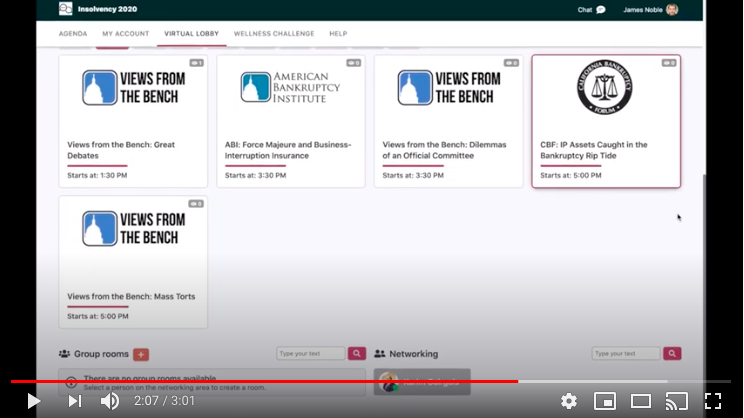

Starting Wednesday! Next Big Wave of Chapter 11s, Force Majeure and Business Insurance and Bankruptcy Issues Related to PPP Loans Among ABI Sessions Featured at Insolvency 2020 Summit

ABI sessions at the Insolvency 2020 Restructuring, Insolvency and Distressed Debt Virtual Summit will highlight and examine the key issues facing the commercial bankruptcy landscape. Sixteen leading insolvency organizations are participating in the Virtual Summit from Sept. 16 – Oct. 27 to bring thought leaders from the worlds of restructuring, insolvency and distressed debt for insightful online programming and engaging networking via a state-of-the-art virtual platform. ABI will be contributing its top-rated sessions, including Great Debates, to add the Summit's flexible schedule of online sessions, creative optional events and virtual networking opportunities. More than 170 leading industry professionals will be taking part on panels at the Summit to offer more than 50 hours of educational content.

ABI sessions at the Insolvency 2020 Restructuring, Insolvency and Distressed Debt Virtual Summit include:

• Views from the Bench: Great Debates

• Force Majeure and Business-Interruption Insurance

• Views from the Bench: Dilemmas of an Official Committee

• Views from the Bench: Mass Torts

• Views from the Bench: Sales — Chapter 11 or § 363?

• Views from the Bench: Confirmation Roundtables: Competing Interests in Today's Chapter 11

• ABI: How to Restructure an Industry that Has Been Shut Down, and How to Prove Feasibility When You're Starting from Ground Zero

• ABI: Next Big Wave of Chapter 11's: Corporate Real Estate

• ABI: Bankruptcy Issues Related to PPP Loans and Other Pandemic Governmental Lending Programs

• Views from the Bench: Ethics

For more information and to register, please click here.

|

|

Sign up Today to Receive Rochelle’s Daily Wire by E-mail!

Have you signed up for Rochelle’s Daily Wire in the ABI Newsroom? Receive Bill Rochelle’s exclusive perspectives and analyses of important case decisions via e-mail!

Tap into Rochelle’s Daily Wire via the ABI Newsroom and Twitter!

|

|

|

|

| BLOG EXCHANGE |

|

New on ABI’s Bankruptcy Blog Exchange: Transferring Personally Identifiable Information in Bankruptcy M&A

With data privacy issues constantly in the news, a recent blog post looked at what businesses need to know about handling personal information when they’re considering bankruptcy, especially if some personal information — like customer records — may be a valuable asset.

To read more on this blog and all others on the ABI Blog Exchange, please click here.

|

|

|

|